A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems. A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers. If hedge accounting cannot be applied, changes in the fair values of derivative instruments are recognized in earnings in each reporting period, which may or may not match the period in which the risks that are being hedged affect earnings. The goal of hedge accounting is to match the timing of income statement recognition of the effects of the hedging instrument with the timing of recognition of the hedged risk. Companies can use derivative instruments to hedge against multiple types of exposures. Common derivatives consist of forward contracts (forwards), futures, foreign currency options (options), contracts for differences (CFDs) and currency swaps.

Additional course costs

Some management accountants advance from entry or mid-level positions like auditing clerk, bookkeeper, or assistant controller. Over recent decades, the corporate world has seen a growing emphasis on Environmental, Social, and Governance (ESG) factors and sustainability issues. Companies are now evaluated not only for their financial performance but also for their commitment to ESG principles and sustainable practices.

How Cherry Bekaert Can Help

These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. The five major types of accounting are cost accounting, managerial accounting, industrial accounting, private accounting, and corporate accounting. They prepare data—recording and crunching numbers—that their companies use for budgeting and planning purposes. They are also responsible for managing risk, planning, strategizing, and decision making.

Create a Free Account and Ask Any Financial Question

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Cost-Volume-Profit (CVP) Analysis

Translation exposure is the degree to which the business’s parent company financials are impacted by currency exchange rate volatility. Global businesses operating in multiple countries or investing in foreign currencies must have a thorough understanding of foreign exchange principles to manage risks (exposure). To operate increased investment in subsidiary journal entry at peak performance, management should understand the types of exposure present, available foreign exchange instruments, hedge accounting practices and accounting for foreign exchange transactions. The goal of a business is to generate profit, which is the difference between income and costs in a particular time period.

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. You can become a chartered global management accountant through the American Institute of CPAs and the London-based Chartered Institute of Management Accountants by passing an exam. The most significant recent direction in managerial accounting is throughput accounting; which recognizes the interdependencies of modern production processes. For any given product, customer or supplier, it is a tool to measure the contribution per unit of constrained resource.

- Tuition costs vary widely, with in-state and online programs often charging lower tuition.

- Appropriately managing accounts receivable (AR) can have positive effects on a company’s bottom line.

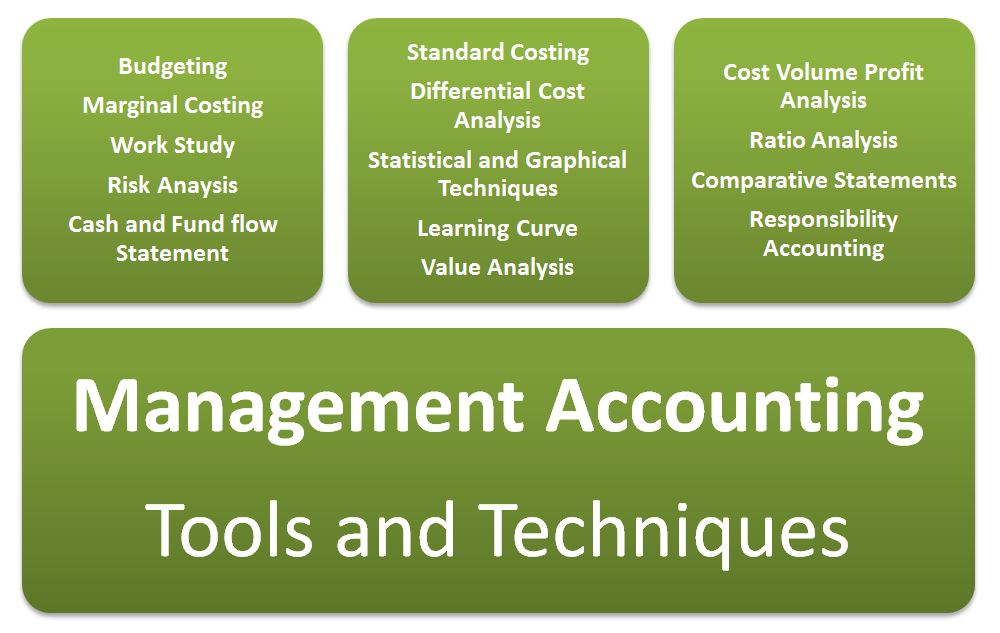

- Cost-volume-profit (CVP) analysis is the tool that managers can use to better understand the answers to “what-if” questions in order to make better decisions for their companies.

- Other duties include supervising lower-level staff, identifying trends and opportunities for improvement.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance. Cherry Bekaert LLP and Cherry Bekaert Advisory LLC practice in an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable law, regulations and professional standards. Cherry Bekaert LLP is a licensed independent CPA firm that provides attest services to its clients, and Cherry Bekaert Advisory LLC and its subsidiary entities provide tax and business advisory services to their clients. Companies mitigate foreign exchange risks by entering into separate contracts that meet the definition of a derivative instrument. For such circumstances, FASB’s ASC 815 allows entities to use a specialized hedge accounting for qualified hedging relationships.

It uses information relating to costs of products or services purchased by the company. Management accountants use performance reports to note variances between actual results from budgets. “Management accountants expand this base of skills to include knowledge of cost accounting and, my favorite, finance tools such as discounted cash flow,” Knese says.

Even those who choose distance learning may decide to attend a nearby college to participate in in-person meetings and events. Tuition costs vary widely, with in-state and online programs often charging lower tuition. However, more expensive schools sometimes offer better opportunities, more prestige, and hefty financial aid packages. Check return on investment and student outcome measures when assessing the value of prospective programs. Accounting curricula differ widely by school, degree level, program, and concentration. However, most accounting bachelor’s programs feature core courses in accounting information systems, auditing, and intermediate and advanced accounting.

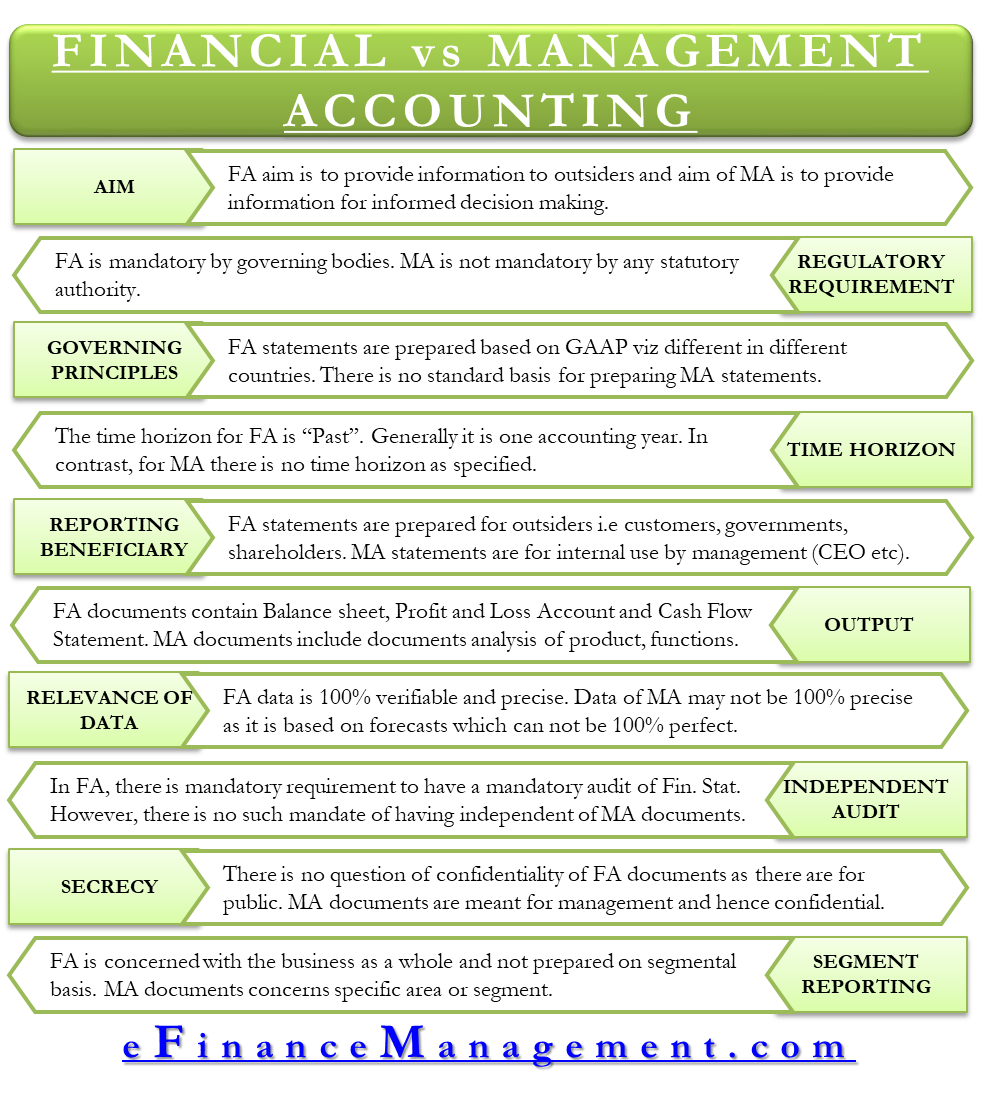

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – or from 11 Financial upon written request. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. Management accounting is concerned with preparing and presenting accounting information in such a way as to assist a firm’s management in designing policies, planning, and controlling the operations of the undertaking.