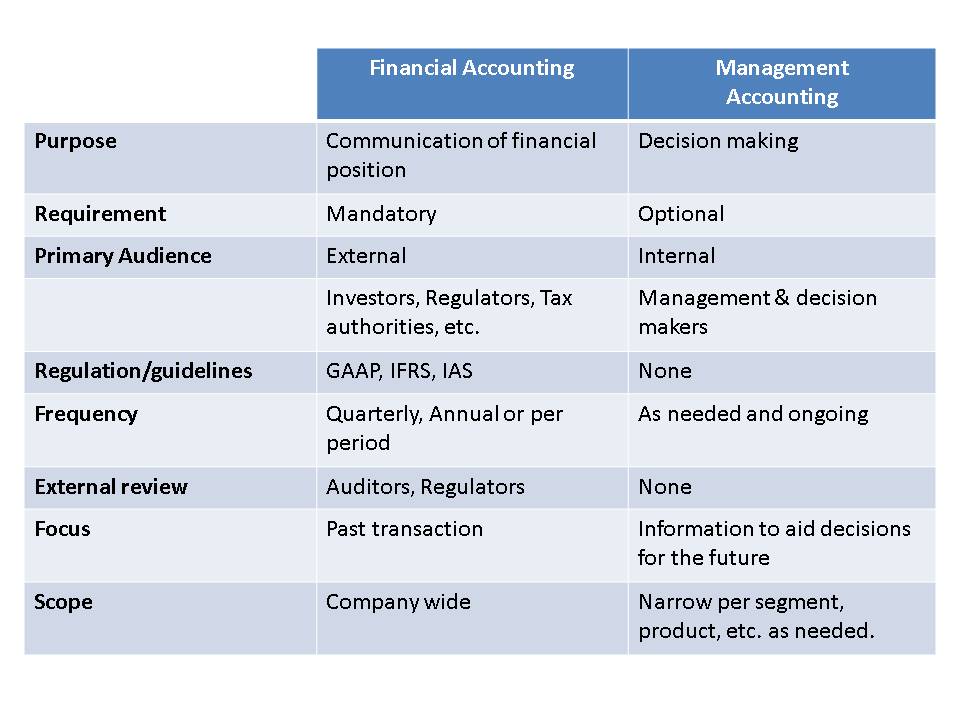

This includes increased job opportunities, higher annual earnings, and distinction within your industry. Accounting managers work to ensure the timely delivery of financial reports to an organization’s decision-makers. This role ensures the accuracy of reports, manages the performance of other accountants, and allocates tasks among other accountants. Financial accountants are also subject to compliance with government rules and regulations, such as the generally accepted accounting principles (GAAP), whereas managerial accountants are not. Katie Thomas, CPA, is not only a thought leader for accountants and other professionals, but she is also a coach for anyone wanting to develop the skills to become a thought leader. I had the pleasure of meeting Katie, virtually, and want to share some of what she does and says.

Is Financial Accounting the Same As Managerial Accounting?

As you can probably tell already, selling and administrative expenses are a bit of a mixed bag. They include highly variable expenses such as marketing as well as mostly fixed expenses such as rent. Because of this dynamic, a manager analyzing these numbers should make sure to distinguish between the company’s baseline fixed costs and the incremental variable costs that rise and fall over time.

Explore the Management Accounting Course Catalog

The positive or negative deviations from a budget also referred to as budget-to-actual variances, are analyzed in order to make appropriate changes going forward. Once you submit your application, we will assess your experience and training, identify the best-qualified applicants, and refer those applications to the hiring manager for further consideration and interviews. To check your status, log on to your USAJOBS account, click on “Application Status,” and then click “More Information.” We expect to make a job offer within 60 days after the deadline for applications. If you are selected, we will conduct a suitability/security background investigation. The candidate has (a) a background in accounting, finance, economics, or psychology (b) good quantitative and communicative skills, (c) an international focus, and (d) an interest in accounting, corporate communication and/or corporate incentive schemes. The Ph.D. student will undergo comprehensive training in accounting, finance, and (applied) statistical and research methods during the first year of the program.

Remote job

Business owners and managers use it to help make important business decisions, such as whether to invest in various assets, buy or sell a business, start a new operation or spin off a new line of products. By synthesizing traditional accounting with advanced business strategy and analysis, management accounting also serves as an excellent foundation for financial management careers such as accounting manager or financial controller. Many management positions require a master’s degree, professional certifications, and/or experience in the field. Financial controller salaries average about $83,000 annually, according to PayScale salary data. According to BLS job outlook data for accountants and auditors, management accountants often advance into high-level executive positions and controller roles. A management accounting concentration can help position accountants for such advancements.

Management Accounting FAQs

Managerial accounting information is aimed at helping managers within the organization make well-informed business decisions, while financial accounting is aimed at providing financial information to parties outside the organization. After obtaining a degree, build your skills while gaining experience to prepare yourself for future employment or certification. Some management accountants advance from entry or mid-level positions like auditing clerk, bookkeeper, or assistant controller.

- The Big 4 accounting firm announced that it will invest $1 billion over three years in talent and technology.

- Proper handling of restricted funds is essential—not only for compliance with accounting standards but also for maintaining the trust and confidence of donors, whose continued support often hinges on transparent and ethical fund management.

- Common derivatives consist of forward contracts (forwards), futures, foreign currency options (options), contracts for differences (CFDs) and currency swaps.

- Management accounting uses both financial and cost information to advise managers in planning and controlling the organization.

- It prepares you for a career in accounting leadership by demonstrating your competencies in the key skills hiring managers look for in candidates.

- Companies can use derivative instruments to hedge against multiple types of exposures.

Managerial accounting is a specified type of accounting that has different job titles based on the company, industry, education, location, and more. The job titles often differ in salary and responsibilities, though you’ll find some common tasks and skills in most jobs in managerial accounting. If you want to pursue certification to become a certified management accountant, you have to be a member of the IMA. To stay certified, you’ll have to pay an annual membership fee and complete ongoing continuing education requirements. In this guide, we will provide a comprehensive overview of best practices for managing restricted funds, covering strategies for compliance, clear reporting, and optimizing fund use to meet organizational and donor goals. By following these guidelines, nonprofits can fulfill their obligations, strengthen donor relationships, and maximize the impact of each contribution.

I know there are many different routes available to you, but trust me when I say the CMA is the best. CIMA offers the Certificate in Business Accounting, which students can complete in order to progress to the full CIMA CGMA Professional Qualification. You will be working as part of a team and need to know how to lead and support your colleagues across a multitude of tasks. Take how to prepare a master budget for your business in 2021 self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Appropriately managing accounts receivable (AR) can have positive effects on a company’s bottom line.

While management accounting can help businesses in many ways, it still presents challenges. For starters, the usefulness of management accounting depends on the quality of the information used to create the analyses. You must generate accurate, up-to-date reports for this accounting method to be helpful, though most accounting software makes this relatively easy. Some students prefer attending local on-campus or online programs to enhance networking opportunities in their area. Self-directed, busy professionals often benefit from the flexible attendance options of online programs. Even those who choose distance learning may decide to attend a nearby college to participate in in-person meetings and events.

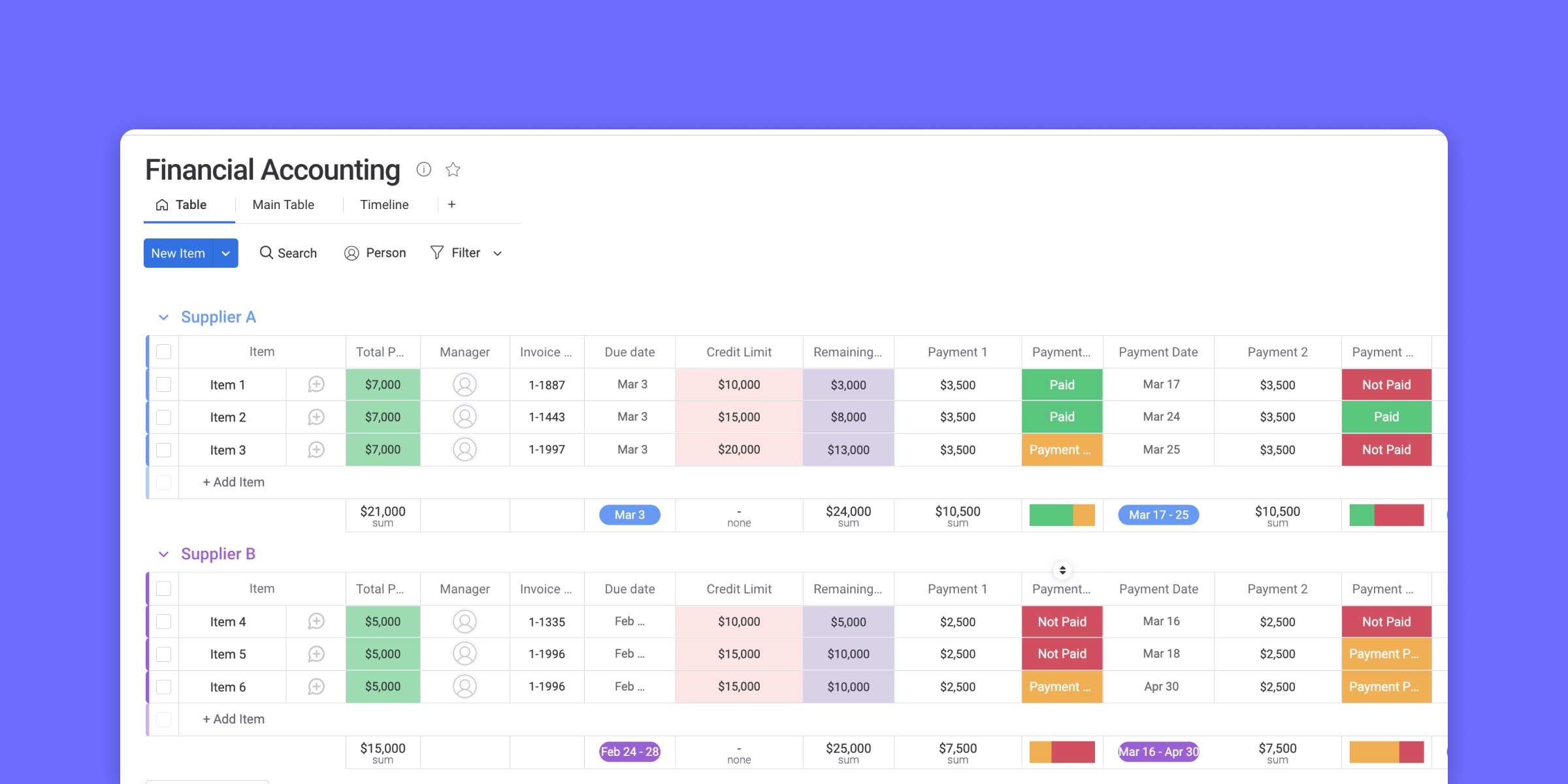

For example, a company’s marketing budget will certainly be reviewed independently of its engineering expenses. However, it could be useful to review marketing and sales expenses together as one group relative to sales or sales growth. These choices are at the management’s discretion based on the company’s business model and objectives. Again, with managerial accounting, there are no regulated standards; the reports and modeling should be designed to fit what the company’s management needs to run the business, not what investors need to understand its performance. Foreign exchange exposure is the risk of foreign exchange rates changing and negatively impacting a company’s financial performance when the company holds assets and engages in transactions in a foreign currency.